Bank Loan Analysis

Metrics And Dimensions

Metrics And Dimensions

- Total Loan Applications:

Number of applications received, classified as good or bad. - Total Funded Amount:

The total amount of money funded through loans, segregated by good and bad applications. - Total Amount Received:

The total amount of money repaid, with a breakdown by good and bad applications. - Average Interest Rate:

The average rate of interest applied to the loans. - Average Debt-to-Income Ratio (DTI):

The average ratio of a borrower's debt payments to their income. - Profit and Loss:

The net profit and loss from loan applications, broken down by good and bad applications.

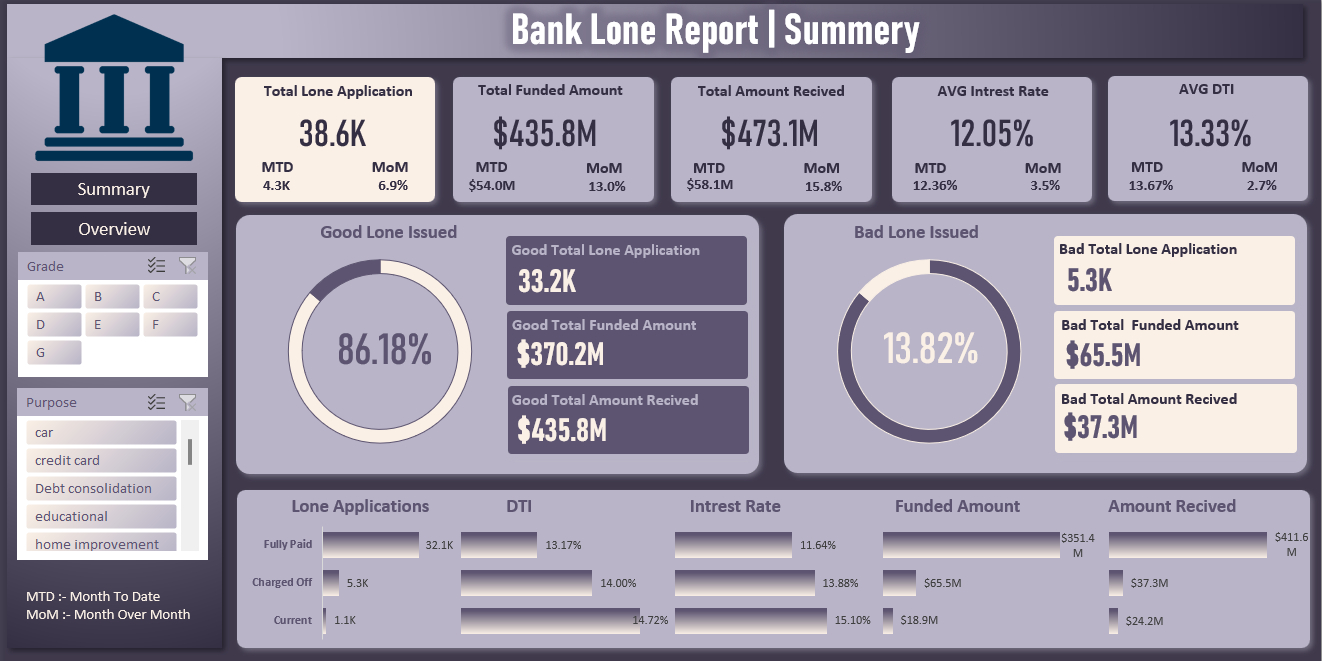

Summary of Insights

- Total Loan Applications:

A total of 38.6K loan applications were received, with 86.18% (33.2K) classified as good and 13.82% (5.3K) as bad. - Total Funded Amount:

The bank funded $435.8 million, with $370.2 million from good applications and $65.5 million from bad applications. - Total Amount Received:

The bank received $473.1 million, with $435.8 million from good loans and $37.3 million from bad loans. - Average Interest Rate and DTI:

The average interest rate across the loans was 12.05%, and the average DTI was 13.33%. - Profit and Loss:

The bank made a profit of $65.6 million from good loan applications and incurred a loss of $28.2 million from bad applications, leading to a net profit of $37.4 million.

Recommendations and Next Steps

- Enhance Risk Assessment:

Implement more rigorous screening criteria for loan applications to reduce the percentage of bad loans, which are currently leading to significant losses. - Optimize Interest Rate Strategies:

Consider adjusting interest rates to better align with the risk profiles of borrowers. Analyzing the impact of different interest rate levels on profit could guide more effective pricing strategies. - Improve Loan Portfolio Management:

Leverage insights from the DTI and other metrics to refine customer targeting and personalize loan offers. This could enhance the profitability of the loan portfolio. - Data Quality Improvement:

Invest in better data collection and management practices to ensure the completeness and accuracy of the dataset. This would facilitate more precise analysis and reliable recommendations in the future. - Actionable Insights Implementation:

Translate the findings into operational strategies by working closely with the risk management and marketing teams to implement these recommendations effectively.

Summery Dashboard

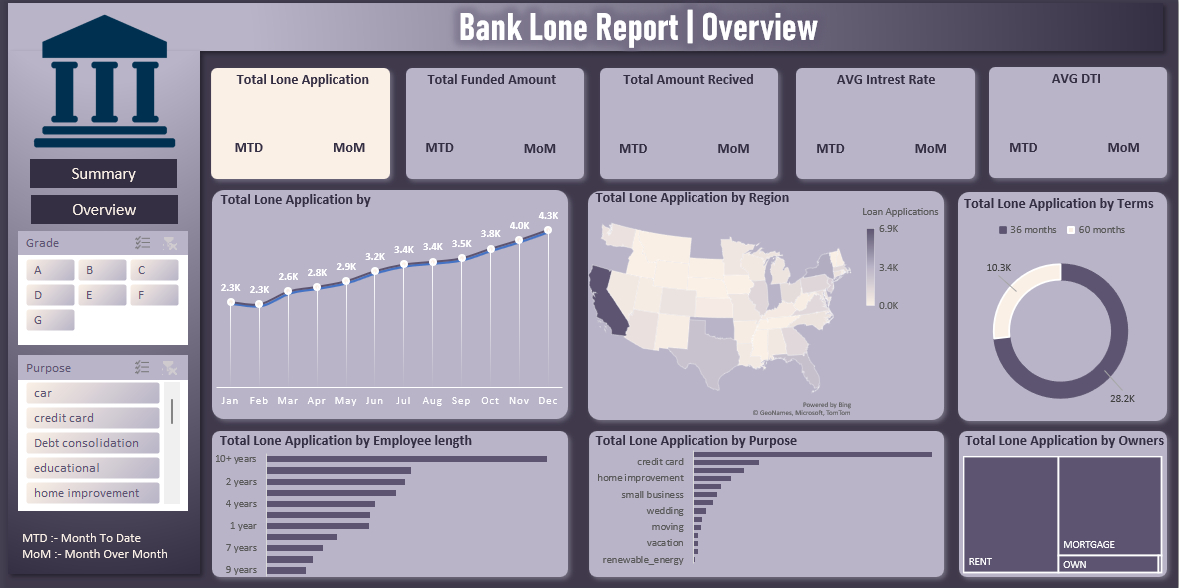

Overview Dashboard